Phone: (850)482-9637; Contact Kim

E-mail: jcgrants@jacksoncountyfl.com

The purpose of the Jackson County Housing Assistance Office is to increase, preserve, and improve housing that is affordable and livable, to the extent possible, ensuring long-term affordability and contributing to neighborhood revitalization.

Jackson County achieves its mission of providing safe, decent, affordable housing for its citizens by maintaining partnerships with:

- Local, state, and federal agencies

- Affordable housing developers

- Non-profit organizations

- Others who share the common goal of producing affordable housing

Jackson County is a recipient of funds from the Florida Housing Finance Corporation, State Housing Initiative Partnership Program (SHIP) for:

- Meeting the housing needs of the very low-, low-, and moderate-income households

- To expand production of and preserve affordable housing

- To further the housing element of the local government’s comprehensive plan, specifically for affordable housing

Presentation on Jackson Housing

Apalachee Regional Planning Council

Apalachee Regional Planning Council is managing the SHIP-State Housing Initiative Program for Jackson County. For Individual Assistance on behalf of Jackson County, please contact Apalachee Regional Planning Council-ARPC.

Hilary Carrasco – HOUSING COORDINATOR

Apalachee Regional Planning Council

2507 Callaway Road, Suite 200, Tallahassee, FL 32303

Phone: (850) 488-6211 ext. 1

Fax: (850) 488-1616

To see if you qualify for SHIP assistance from our housing rehabilitation or first-time homebuyer programs, apply with the link below. For assistance or additional information, please contact Kim at (850) 482-9083.

APPLY HERE: portal.neighborlysoftware.com

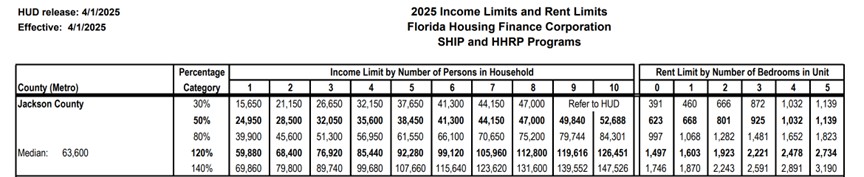

State Housing Initiatives Partnership (SHIP)

SHIP Program for Housing Rehabilitation, Purchase Assistance, Demolition & Reconstruction, and Disaster Mitigation/Recovery

Purchase Assistance Program

The Purchase Assistance Program is designed to assist first-time home buyers with the purchase of an existing single-family home or condominium within Jackson County. Funding, which is provided as a second or subordinate mortgage loan, may be used for:

- Down payment.

- Closing costs.

- Principal buy-down.

- Repairs needed for affordable home ownership.

SHIP funds may be used in conjunction with a first mortgage loan obtained from participating lenders, Florida Housing Finance Corporation’s Bond Program, or Rural Development.

Rehabilitation Program

Oftentimes, repairs are not made when needed, due to a lack of personal funds and/or adequate Federal subsidy programs to assist families in despair. Jackson County supports efforts to conserve, protect, and rehabilitate housing by offering an Owner-Occupied Rehabilitation Program designed to assist eligible homeowners with moderate rehabilitation needs or emergency repair assistance for owner-occupied homes to address repair needs for:

- Roofing

- Electrical

- Plumbing

- Sanitary disposal

- Life/safety conditions

- Structural code deficiencies

- Other related repairs

*Note regarding the above two programs: Funds are secured with a five (5) or ten (10) year, recorded, zero-interest, and deferred payment mortgage loan; monthly payments are not required. Repayment of the loan is required in full when one of the following conditions is met during the term of the note only, whichever occurs first:

- Sale

- Title transfer

- Refinances to access equity, and the homeowner no longer resides in the home.

Demolition and Reconstruction

This strategy is designed to replace existing uninhabitable or dilapidated structures for homeowners who do not have alternative housing or financial resources to alleviate the situation. The home must be located in Jackson County, Florida, owner-occupied, with a clear title. Taxes and assessments must be current. The existing structure must be certified by the Jackson County Housing Director and Jackson County Certified Building Officer as substandard and not suitable for rehabilitation.

Application acceptance is based on funding available. For more information about the application requirements for the State Housing Initiative Partnership (SHIP) programs, please call our SHIP Program office at (850) 488-6211

Local Housing Assistance Plan

Escambia County Housing Finance Authority

Down Payment Assistance Programs

The Florida Assist (FL Assist) program allows eligible borrowers purchasing in the county to receive down payment assistance through a second mortgage. It is a deferred repayment loan in the event of sale, transfer, satisfaction of the first mortgage, refinancing of the property, or until such time the mortgagor ceases to occupy the property, at which time, the Florida Assist will become payable in full

3%, 4% and 5% HFA Preferred and HFA Advantage PLUS Second Mortgage: Borrowers utilizing these down payment and closing cost programs receive 3%, 4% or 5% of the total loan amount in a forgivable second mortgage. This second mortgage is forgiven at 20% a year over its 5-year term. The Florida Homeownership Loan Program (FL HLP) Second Mortgage: Borrowers purchasing in the county selected may also be eligible to receive down payment assistance (DPA) through the FL HLP Second Mortgage Program. The FL HLP offers the following:

The Florida Homeownership Loan Program (FL HLP) Second Mortgage: Borrowers purchasing in the county selected may also be eligible to receive down payment assistance (DPA) through the FL HLP Second Mortgage Program. The FL HLP offers the following:

- Up to $10,000.

- 3% fully-amortizing, second mortgage.

- 15-year term

The FL HLP Second Mortgage carries a monthly payment. The remaining unpaid principal balance (UPB) is deferred, except in the event of the sale, transfer of deed, satisfaction of the first mortgage, refinancing of the property or until such a time the mortgagor(s) ceases to occupy the property as his/her primary residence at which time, the FL HLP Second Mortgage will become payable, in full.

Rural Development

Program Information

Low-interest, fixed-rate Homeownership loans are provided to qualified persons directly by USDA Rural Development. Financing is also offered at fixed rates and terms through a loan from a private financial institution and guaranteed by USDA Rural Development for qualified persons. Neither one of these home loan programs requires a down payment.

USDA Rural Development also offers competitive grants to public and private non-profit Self-Help Housing organizations and Federally Recognized Tribes to enable hardworking families to build their own homes.

Rural Development Single Family Housing Programs:

- Single Family Housing Direct Home Loans

- Single Family Housing Home Loan Guarantees

- Housing Preservation Grant

- Mutual Self-Help Housing Technical Assistance Grants

- Rural Housing Site Loans

Single Family Housing Repair Loans and Grants provide funds to elderly and very-low-income homeowners to remove health and safety hazards, perform necessary repairs, improve or modernize a home, make homes accessible for people with disabilities, or make homes more energy efficient so these very-low-income families use less of their income on utility bills.

For more information about Single-Family Housing Programs or to find out if you are qualified, contact 850-526-2610 x5 or visit the office located at 2741 Penn Avenue, Marianna, FL 32446.

Weatherization Assistance Program

This program assists income-eligible families and individuals by reducing their heating and cooling costs and addressing health and safety issues in their homes through energy efficiency measures. The department assists Jackson County customers.

For additional program information, please contact the housing department at 850-679-4817.

Visit the website at: Community Action Program Northwest Florida – Home Energy Assistance (capc-pensacola.org)

Jackson County wants you to know that fair housing is your right! If you have been denied your housing rights…you may have experienced unlawful discrimination.

The Jackson County Board of County Commissioners is dedicated to Fair Housing principles. The Fair Housing Act protects all persons against housing discrimination. The JCBOCC officially adopted a Fair Housing Ordinance, which prohibits discrimination in housing because of race, color, national origin, religion, age, sex, handicap, genetics, and familial status. This ordinance covers most housing-related activities, such as real estate sales, advertising, bank transactions, mortgages, rentals, and any similar activity that may deal with persons seeking housing. JCBOCC urges anyone with questions concerning Fair Housing, or anyone who feels they have been discriminated against, to contact the Jackson County Housing Grants Coordinator at (850) 482-9083. Watch Cheryl’s story to understand more about housing discrimination.