Supplemental Distribution Revenue Sharing Program

Supplemental Distribution Revenue Sharing Program

Request to provide additional funds to avoid prorated reduction

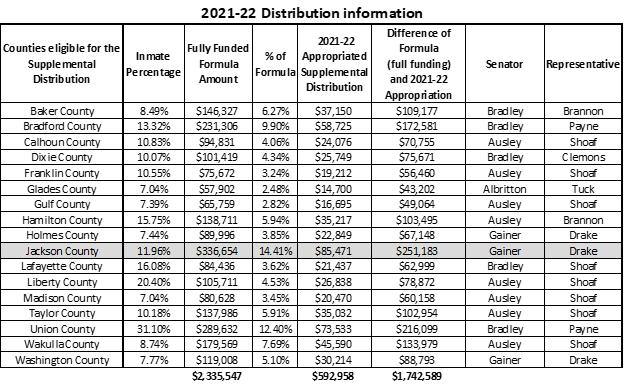

The Supplemental Distribution within the Local Government Half-Cent Sales Tax revenue sharing program has been funded at $592,958 in the annual GAA. The amount is below the $2,335,547 amount resulting from the statutory calculation for the supplemental allocation. As a result, 17 small counties that qualify for the Supplemental distribution have had their allocation prorated down from the $2,335,546 derived from the formula to the $592,958 appropriated in the GAA. The proration results in the “loss” of $1,742,589 of additional funding contemplated by the formula.

Request – The Legislature is requested to increase that allocation of funding to the Emergency distribution to provide sufficient funding for full funding of the Supplemental Distribution. This can be done by adjusting the % in statute by increasing the distribution to the emergency and supplemental distribution so that the full allocation to the supplemental distribution can be made annually while still allowing the emergency distribution to remain at the current forecast level. The current full allocation using the formula in section 218.65(8) to the supplemental distribution is $2,335,547 and the amount appropriated from the amount deposited to the Local Government Half-cent Sales Tax Clearing fund pursuant to section 212.20(5)(d)3. is $592,958, leaving a gap of $1,742,589. Using the August 17, 2021 General Revenue Estimating Conference workpapers, the forecast amount deposited pursuant to s.212.20(5)(d)3. is $$27,900,000 at the current rate of 0.0966%. In order to generate the additional $1,742,589 to allow for a fully funded supplemental program, the rate need to be increased to 0.1026%.

Further detail and background is provided:

Local Government Financial Information Handbook 2021 – Pages 55 through 73 provide a description, summary and distribution charts for the Local Government Half-cent Sales Tax Program Sections 202.18(2)(c), 212.20(6), 218.60-.67, and 409.915, Florida Statutes

Authorized in 1982, the Local Government Half-cent Sales Tax Program generates the largest amount of revenue for local governments among the state-shared revenue sources currently authorized by the Legislature.1 It distributes a portion of state sales tax revenue via three separate distributions to eligible county or municipal governments.

The program’s primary purpose is to provide relief from ad valorem and utility taxes in addition to providing counties and municipalities with revenues for local programs. The program includes three distributions of state sales tax revenues collected pursuant to ch. 212, F.S.

- The ordinary distribution to eligible county and municipal governments is possible due to the transfer of 8.9744 percent of net sales tax proceeds to the Local Government Half-cent Sales Tax Clearing Trust Fund [hereinafter Trust Fund].2

- The emergency and supplemental distributions are possible due to the transfer of 0.0966 percent of net sales tax proceeds to the Trust Fund.3 The emergency and supplemental distributions are available to select counties that meet certain fiscal-related eligibility requirements or have an inmate population of greater than seven percent of the total county population, respectively.

A county government, which meets certain criteria, participates in the monthly emergency and supplemental distributions, and such qualification is determined annually at the start of the fiscal year.

- Participation in the emergency distribution is dependent on the existence of a defined fiscal emergency. The Legislature has declared that a fiscal emergency exists in any county that meets both conditions listed below.

1. The county has a population of 65,000 or less; and

2. The monies distributed to the county government pursuant to s. 218.62, F.S., for the prior fiscal year were less than the current per capita limitation, based on the county’s population.

- Any county having an inmate population greater than seven percent of its total population is eligible for a supplemental distribution for that year from funds expressly appropriated by the Legislature for that purpose. Inmate population means the latest official state estimate of the number of inmates and patients residing in institutions operated by the federal government, the Florida Department of Corrections, or the Florida Department of Children and Families.

- At the beginning of each fiscal year, the DOR calculates a supplemental allocation for each eligible county equal to the current per capita limitation pursuant to s. 218.65(4), F.S., multiplied by the county’s inmate population. If monies appropriated for the current year’s distribution are less than the sum of the supplemental allocations, each eligible county receives a share of the appropriated total that is proportional to its supplemental allocation. Otherwise, each eligible county receives an amount equal to its supplemental allocation.

Distribution of Local Government Half-cent Sales Tax for the year ending Sept. 1, 2022

- Ordinary distribution – $2,363,675,000 distributed to eligible counties and municipalities.

- Emergency Distribution – $27,307,042 distributed to 20 eligible counties.

- Supplemental Distribution – $592,958 distributed to 17 eligible counties. *,**.

*Full funding of the supplemental distribution according to the statutory formula would total $2,335,547.

** In accordance with the statutes, the supplemental distribution allocation was decreased by $1,742,589 through a proration to the amount appropriated in the GAA. ($592,958)